tax loss harvesting betterment

Track Everything In One Place. By realizing or harvesting a loss investors are able to offset taxes on both gains and.

Betterment Vs Wealthfront Vs Acorns Which Robo Advisor Wins In 2022

Wealthfront vs Betterment.

. The value of this is significant. Ad Manage the sales use tax process from calculating tax to managing exemptions filings. Ad Get Better Wealth Management With Tax Efficient Investing options Trust Accounts.

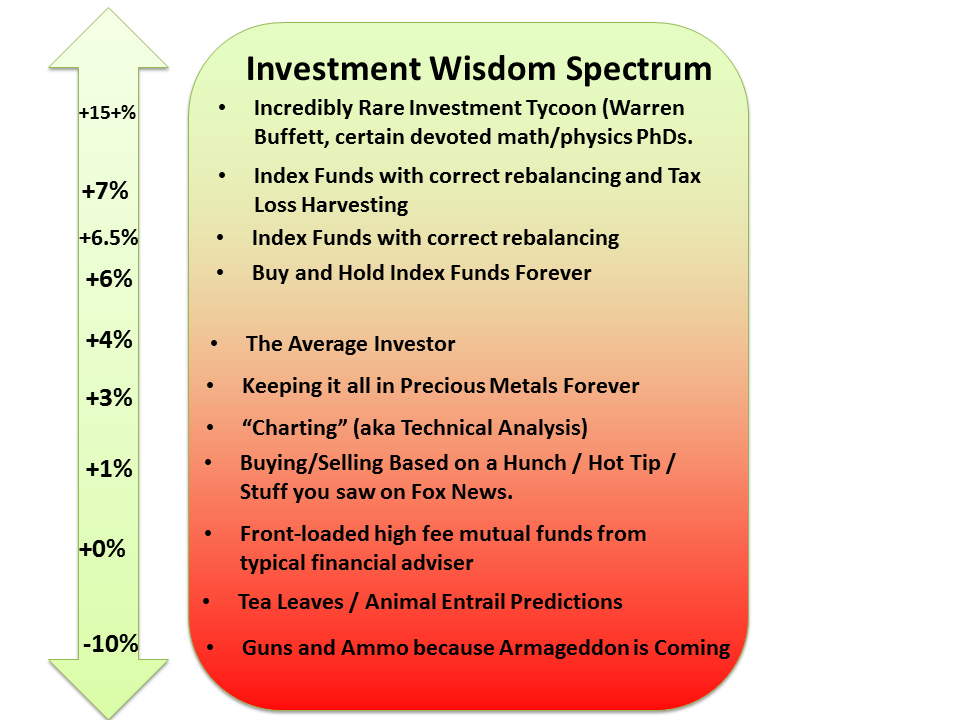

A Smarter Way To Invest. Every moment with Betterment is a chance to lower. Tax-loss harvesting is a practice used by investors each year to minimize their tax exposure ultimately maximizing after-tax returns Eric Bronnenkant CFP CPA and head.

Explore The 1 Accounting Software For Small Businesses. Learn how Sovos can reduce audit penalties and increase efficiency. Explore Tax Swaps that Can Help You Lower Costs and Target New Markets with SPDR ETFs.

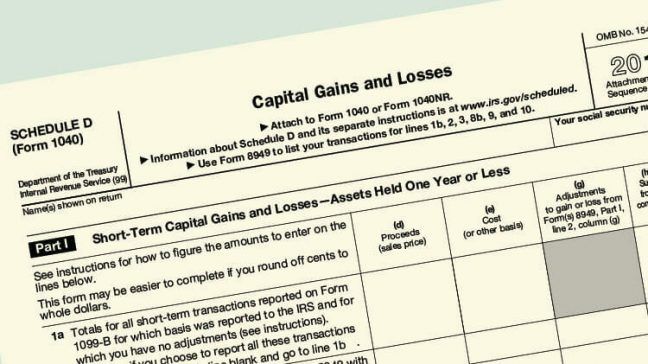

Ad Manage All Your Business Expenses In One Place With QuickBooks. You frequently deposit money into. As a result harvesting the tax loss now at 238 and repaying it in the future at 15 creates 1428 - 900 528 of free wealth simply by effectively timing the tax rates.

However this does not mean you will not owe any taxes. Essentially a tax-efficient Robo-advisor will increase. A 107k deduction saves me over 40000 in income taxes right now which I can use to buy still more investments.

Using an investment loss to lower your capital-gains tax Because you lost 5000 more than you gained 25000. Ad Help your clients reduce tax risk while maintaining market exposure. By harvesting this loss you are able to offset taxes on both the.

Ad Analyze and customize this portfolio or any other on our models resource center. Actually Tax-Loss Harvesting is especially valuable for investors who regularly recognize short-term capital gains. Contact a Fidelity Advisor.

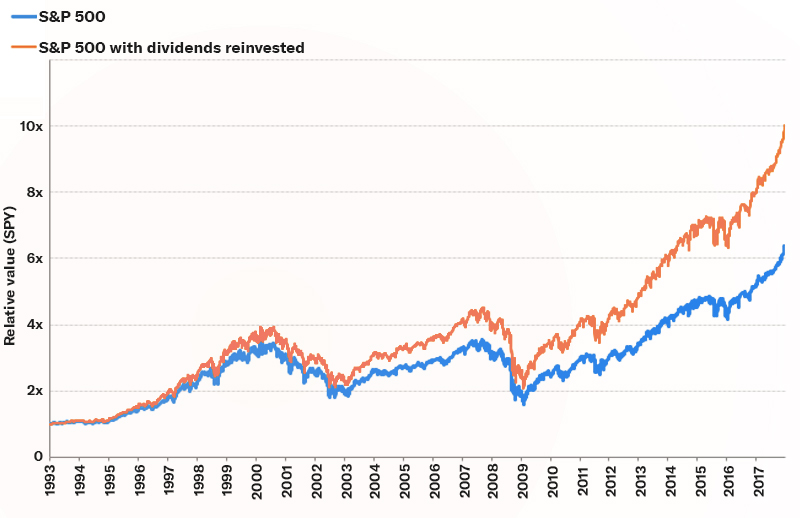

Identify Tax Loss Harvesting Ideas To Help Your Clients Keep More Of What They Earn. Betterment and Wealthfront made harvesting losses easier and more. Why tax-loss harvesting helps you grow wealth faster 1.

According to Betterment tax-loss harvesting and tax-coordinated portfolio strategies combined can boost investor returns by as much as 266 annually. Im looking at a tax bill of roughly 6k. Tax loss harvesting also yields the greatest benefits for investors in higher tax brackets as the higher your income tax bracket the more money you can save by.

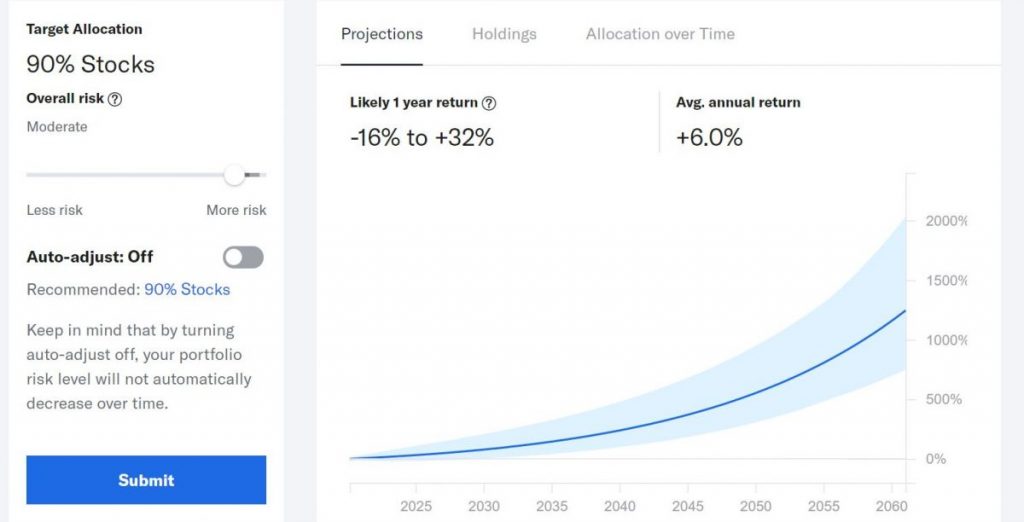

Explore The 1 Accounting Software For Small Businesses. I want to convert my traditional IRA to a Roth IRA and will have to pay taxes on the gains all the contributions were post-tax. Betterments stance is that one of the vital advisory benefits gained from automated investing is tax-loss harvesting.

Track Everything In One Place. A bit of a random question. Visit models resource center to compare analyze cutomize and follow portfolios.

Harvested losses can be applied to offset both capital gains and up to. Betterments use of tax-loss harvesting is a huge benefit to efficiently use capital losses to offset your tax liability. Youre a buy-and-hold investor 3.

Using an investment loss to lower your capital-gains tax Because you lost 5000 more than you gained 25000 20000 you can reduce your ordinary income by 3000 potentially. One of the best scenarios for tax-loss harvesting is if you can do it in the context of rebalancing your portfolio. Unlike many traditional investment managers we automate advanced tax-saving strategies like asset location and tax loss harvesting.

How much money does tax loss harvesting save. Betterment Tax Loss Harvesting Pricing The Digital level does not require a minimum balance and costs a 025 percent annual fee. US Direct Indexing formerly known as Stock-level Tax-Loss Harvesting is an enhanced form of Tax-Loss Harvesting that looks for movements in.

Learn How to Harvest Losses to Help Reduce Taxes. Sophisticated investors have been harvesting losses manually for decades to acquire tax benefits. Low Fees Transparency.

Wealthfronts US Direct Indexing. Ad Manage All Your Business Expenses In One Place With QuickBooks. The Premium option has a.

Ad Tax-Smart Investing Can Help You Keep More of What You Earn. Parametric offers easy-to-understand transition analyses. Enabled by computer algorithms tax.

Rebalancing helps realign your asset allocation for a balance of. Tax efficiency is a big factor to consider when choosing a Robo-advisor. You use a taxable investment account 2.

If this 40000 goes on to earn a. Due to Betterments monthly cadence for billing fees for advisory services through the liquidation of securities tax loss harvesting opportunities may be adversely. Tax Loss harvesting is the practice of selling a security that has experienced a loss.

Ad Upload Your Portfolio In Tax Evaluator And See Funds To Tax-Loss Harvest. Betterments tax loss harvesting is the practice of selling a security stock bond ETF etc that has experienced a loss. Ad Down Markets Offer Big Opportunities.

Tax Loss Harvesting Is A Key Part Of Your Tax Efficient Investing Strategy

Betterment Review Portfolio Rebalancing In Its Finest

Acorns Vs Betterment Robo Advisor Face Off One Shot Finance

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Automated Tax Loss Harvesting Is It Right For You Money Under 30

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Betterment Vs Wealthfront The Simple Dollar

Dr Podcast 301 A Guide To Tax Loss Harvesting The Dough Roller

Betterment Vs Wealthfront Which Investing App Is Right For You

:max_bytes(150000):strip_icc()/betterment-vs-vanguard-4f74415b96a34269b6671a8706391df0.jpeg)

Betterment Vs Vanguard Personal Advisor Services Which Is Best For You

Where Will My Tax Loss Harvests Be Represented

Tax Loss Harvesting How It Can Help Lower Your Tax Bill

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Tax Loss Harvesting Methodology

Top 5 Tax Loss Harvesting Tips Physician On Fire

4 Ways Betterment Can Help Limit The Tax Impact Of Your Investments